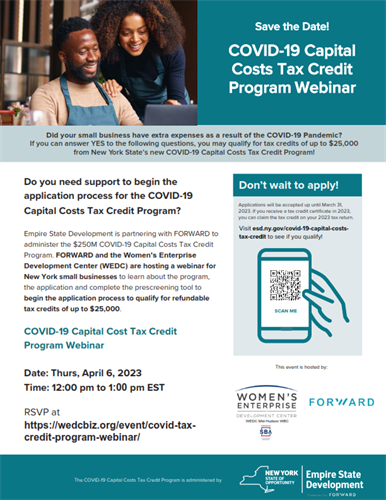

COVID-19 Capital Costs Tax Credit Program Webinar

Did your small business have extra expenses as a result of the COVID-19 Pandemic? If you can answer YES to the following questions, you may qualify for tax credits of up to $25,000 from New York State’s new COVID-19 Capital Costs Tax Credit Program!

Empire State Development is partnering with FORWARD to administer the $250M COVID-19 Capital Costs Tax Credit Program. FORWARD and and the Women’s Enterprise Development Center (WEDC) are hosting a webinar for New York small businesses to learn about the program, the application and complete the prescreening tool to begin the application process to qualify for refundable tax credits of up to $25,000.

Date and Time

Thursday Apr 6, 2023

12:00 PM - 1:00 PM EDT

Location

Online

Fees/Admission

Free

Website

Contact Information

Cynthia Marsh-Croll

Send Email